Is Your QuickBooks company file ready for 2022? Here’s a few ideas so that you can put your QuickBooks records in order.

January is always such a transitional month. You’re trying to wrap up everything that didn’t get done during a hectic December. At the same time, you have to jump into the new year and start doing your regularly scheduled work. It can be hard to tell sometimes which year you’re working on!

Don’t forget about QuickBooks while you’re catching up on 2021 and looking ahead to 2022. You probably don’t want to put one more item on your to-do list, but any steps you take now to ready the software for the new year can pay off in better cash flow, meaningful information, and easier tax filing. Once you start entering transactions and placing orders and welcoming new customers, it will help tremendously to have a clean slate. Here are some suggestions for completing as much of the work you started in 2021 as you can.

Run Four Key Reports

Bills can slip through without being paid in December because there’s so much going on. This applies to both you and your customers. You need to catch up on what’s owed to you and what you owe. So run these four reports to do a quick assessment of where you are. [Accrual is just a fancy way of saying that you use QuickBooks to track customer invoices before you are paid and you track vendor bills before you pay them.]

A/R Aging Detail (accrual users)

- Which of your customers still owe money to you?

- Are there any payments that have not been recorded?

- Look at the next step on creating past-due statements for those customers that need reminders

A/P Aging Detail (accrual users)

- Are you caught up with the money you owe other individuals and companies? This report will tell you.

Profit and Loss (cash and accrual users)

- Does this make sense with your gut intuition of what you made?

- How does it compare with last year? Big differences can highlight recording errors.

- Run the report on the accrual basis to see how much you made last year

- Run the report on the cash basis to get an estimate of what your reportable income may be

Balance Sheet (cash and accrual users)

- Is there an amount in Uncategorized Asset?

- Are there any balances that don’t make sense?

- This is a great time to clean up these accounts.

Create Statements for Past-due Customers

directly with overdue customers is to send statements.

You’ll have to decide how hard you want to lean on customers who are late paying

your bills when it’s so early in the year. Certainly, if some customers are more than 60 days late (30 days if they have sizable balances), you may want to make a phone call or at least send a personalized email asking them to fulfill their obligations.

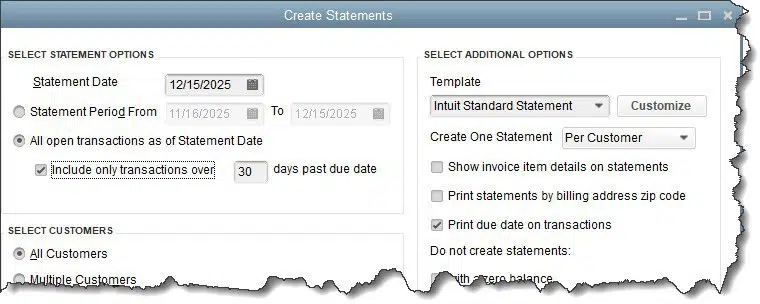

But you can also send statements. These documents provide details of financial activity between you and your customers for a given period of time. Open the Customers menu and click Create Statements. Look over all of the options in the window that opens and indicate your preferences. If customers don’t respond to your statements within 10 days, then it may be time for a phone call.

Review the Chart of Accounts

January is also a good time to be thinking about how you can better use QuickBooks in 2022.

Are there additional categories that could provide more meaningful information to you? Often, we see a large balance for Professional Fees when it is more meaningful to have Marketing Consulting, Accounting Fees, and Legal Fees.

Can small accounts be consolidated?

One of our favorites is to segregate recurring technology charges into Technology Subscriptions. This makes it easier to calculate the monthly cost of your technology infrastructure for all those annual subscriptions.

Set Up Online Financial Connections

January is also a good time to be thinking about how you can better use QuickBooks in 2022. We tend to learn how to use the tools we need and not explore any further when we’re using any kind of software. With so many features offered in QuickBooks, it is easy to be overwhelmed.

But there are two tools that can have tremendous impact on your daily workflow, your ability to get paid faster by customers, and your understanding of where you stand financially every day. They are:

Online Banking

- Did you know that you can connect QuickBooks to many financial institutions and import your cleared transactions every day? That’s what the Bank Feeds Center is all about. If you sign up for this service, you won’t have to wait until your monthly statement comes to see what transactions have gone through.

- On a selected basis, some of the banks are also importing the monthly bank statements into QuickBooks making bank reconciliation

Online Payments

- If you’re only accepting checks as payment from your customers, you’re probably getting paid more slowly than you might. Sign up for QuickBooks Payments, and you’ll be able to process credit cards, eChecks, and ACH payments.

Close The Books

Once all the changes for 2021 have been made, take the extra step to close out the books as of 12-31-2021. You can find this feature in all QuickBooks subscriptions by accessing the gear icon in the upper right-hand corner, selecting Account and Settings under Your Company. Select Advanced from the list on left and under Accounting, there will be a Close The Books option. Once you close the books after all your changes are done, then no changes can be made without a warning (or optionally, a password). Using this feature is a great internal control to ensure your books always match the tax return.

We know you’re busy catching up from the holiday breaks right now. But if you need our help with anything we discussed in this month’s column, please reach out to us. We’re always available to help make your life happier through accounting.

Happy Accounting!